inheritance tax rate kansas

Kansas real estate cannot be transferred with clear title after the death of an owner or co. However the Kansas Inheritance Tax may be payable even though no federal estate tax is due.

Estate Taxes Are A Threat To Family Farms

We have already discussed the fact that Kansas does not have an estate tax gift tax or inheritance tax.

. The surviving spouse and children are exempt from an inheritance tax. Inheritance tax rates differ by the state. 6 rows Kentucky inheritance taxes should be filed within 18 months of the decedents death.

If you make 70000 a year living in the region of Kansas USA you will be taxed 12078. This marginal tax rate means. The state sales tax rate is 65.

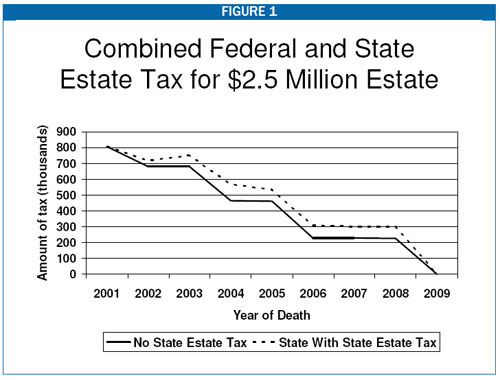

The amount of federal estate tax that will be levied on an estate depends upon the size of the taxable estate and there is a maximum federal estate tax rate of forty percent. The maximum estate tax rate will remain at 16 percent and the inheritance tax will also remain the same. The federal estate tax is calculated on the value of the.

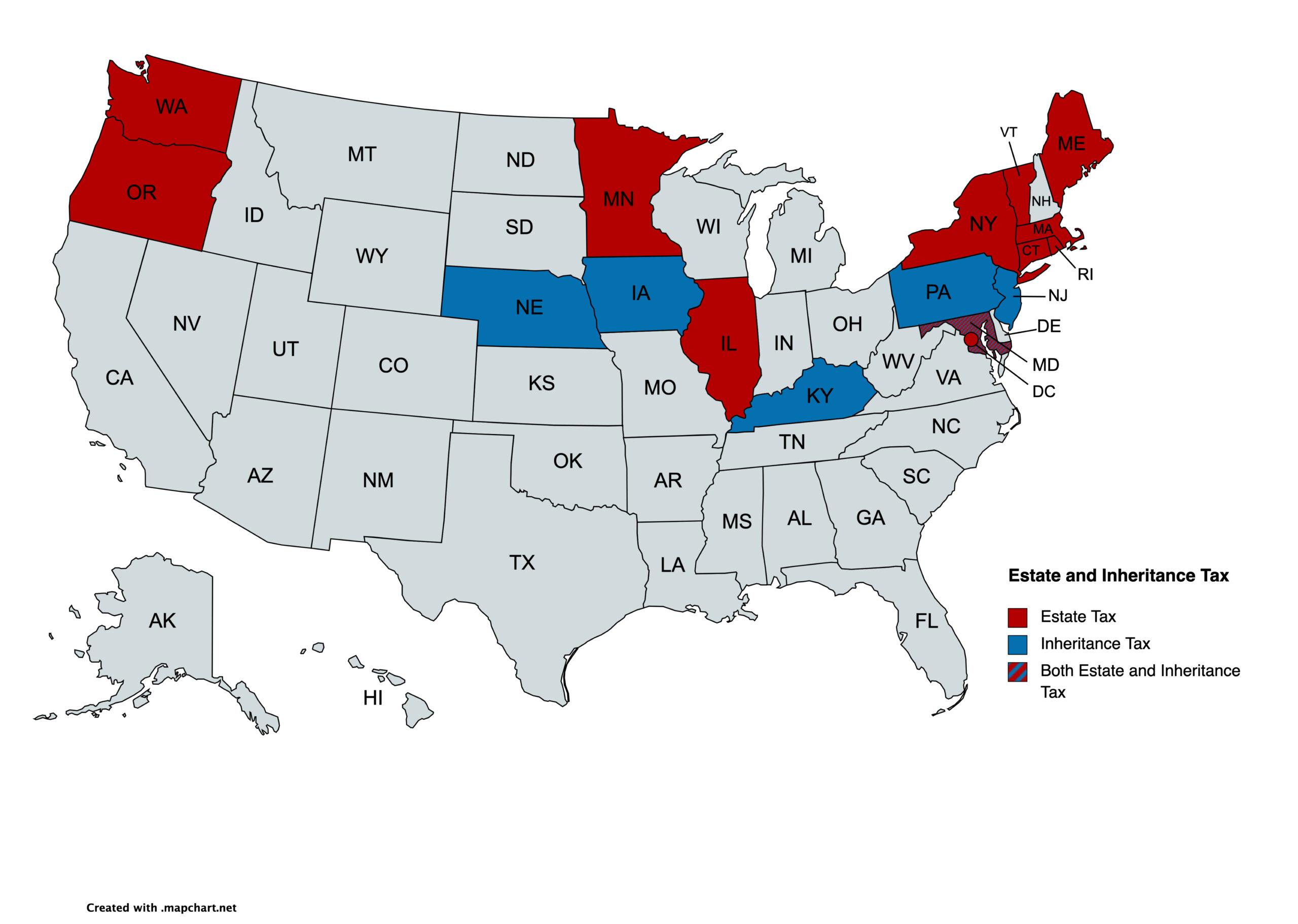

State inheritance tax rates range from. Does Kansas Have An Estate Or Inheritance Tax. The kansas inheritance tax is based on the value of the assets received by the heir and the heirs degree of kinship to the deceased.

These states have an inheritance tax. State inheritance tax rates range from. The kansas inheritance tax is based on the value of the assets received by the heir and the heirs degree of kinship to the deceased.

Estate tax and inheritance tax in kansas estate planning. The amount of federal estate tax that will be levied on an estate depends upon the size of the taxable estate and there is a maximum federal estate tax rate of forty percent. As of 2021 the six states that charge an inheritance tax are.

Kansas taxes Social Security income only for those with an Adjusted Gross. Your average tax rate is 1198 and your marginal tax rate is 22. The top estate tax rate is 16 percent exemption threshold.

The standard Inheritance Tax rate is 40. Many cities and counties impose their.

Estate And Inheritance Tax State By State Housing Gurus

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

The Estate Tax And Real Estate Eye On Housing

How Do State And Local Individual Income Taxes Work Tax Policy Center

Assessing The Impact Of State Estate Taxes Revised 12 19 06

What Is Inheritance Tax Probate Advance

Kansas Health Legal And End Of Life Resources Everplans

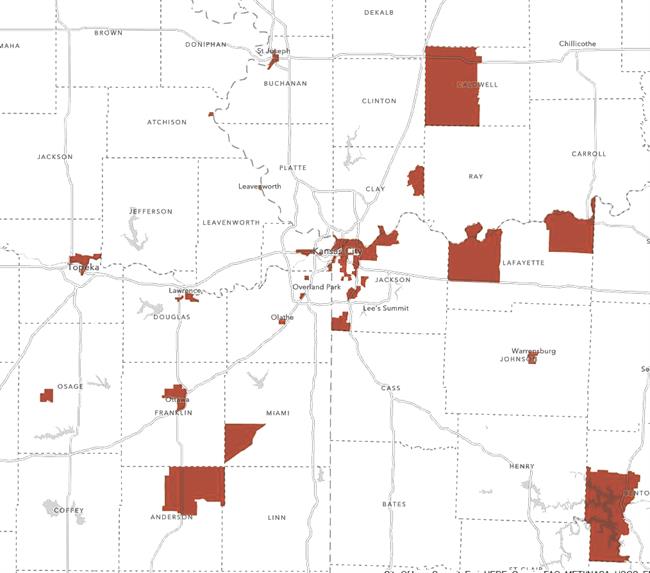

Kc Region Taxes Financial Incentives Profile Kcadc

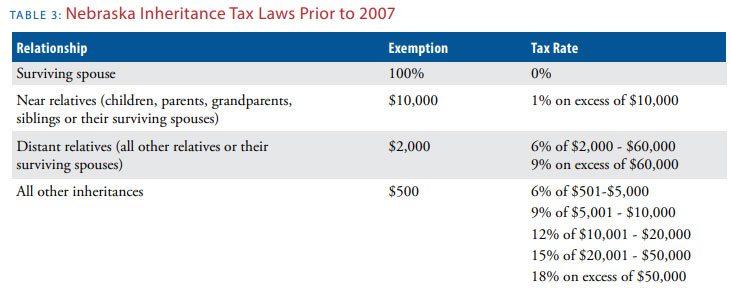

Death And Taxes Nebraska S Inheritance Tax

The Ethics Of Taxation Trilogy Part I Seven Pillars Institute

Kansas State Taxes Ks Income Tax Calculator Community Tax

Estate Tax And Inheritance Tax In Kansas Estate Planning Weber Law Office P A

Kansas State Taxes Ks Income Tax Calculator Community Tax

General Sales Taxes And Gross Receipts Taxes Urban Institute

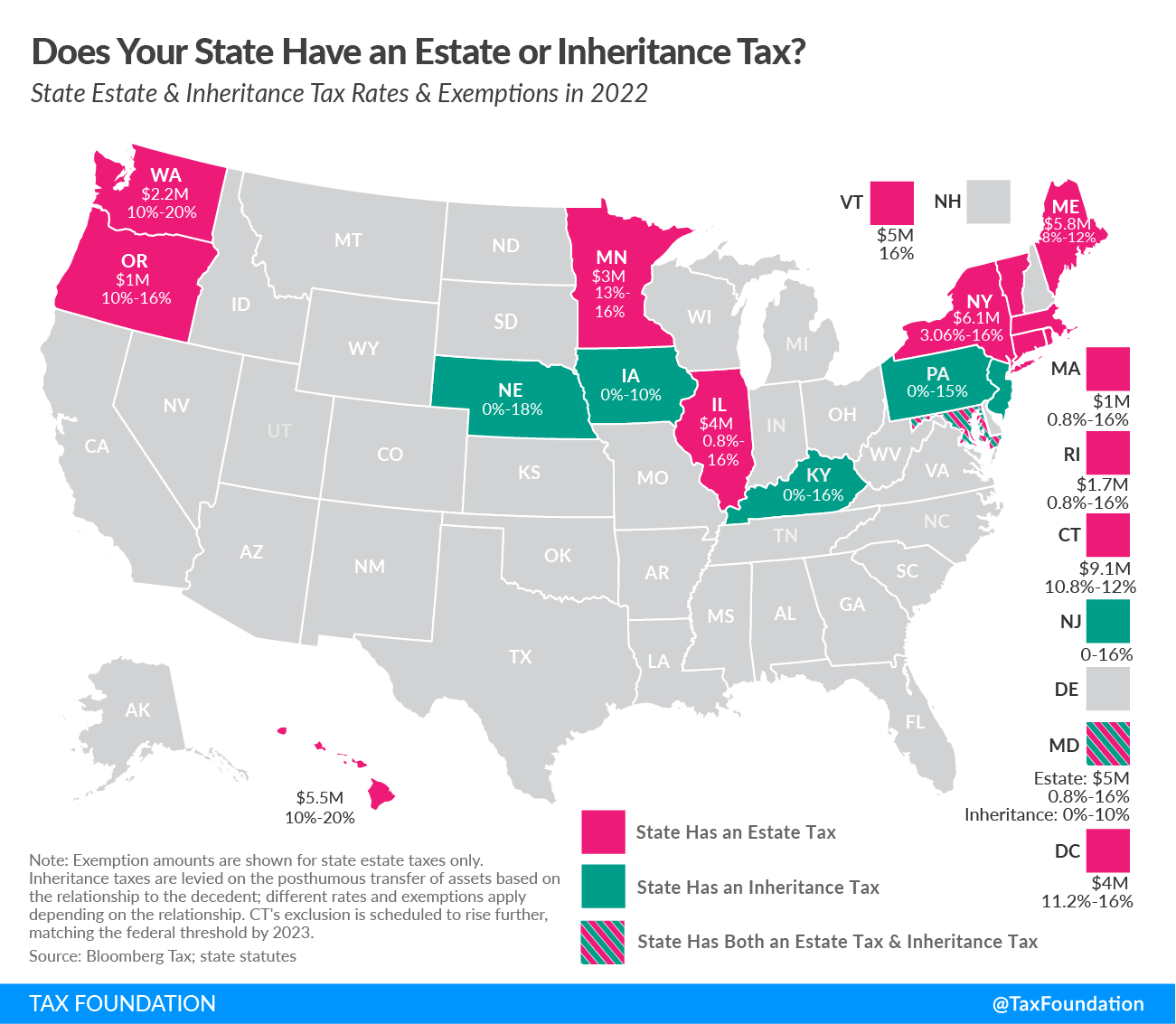

State Estate Tax Rates State Inheritance Tax Rates Tax Foundation

Inheritance Tax Return Nonresident Decedent Rev 1737 A Pdf Fpdf Docx Pennsylvania

State By State Estate And Inheritance Tax Rates Everplans